Table Of Content

This makes Charlotte an incredibly affordable city, as housing is 14% cheaper on average than the rest of the country. NerdWallet, PayScale, and Best Places all give Charlotte favorable scores for housing. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. Like many places around the U.S., rental costs have gone up significantly during 2021.

Transportation Costs in Charlotte

These tools, which are typically free, provide a comparison based on income and regional costs for housing, transportation, food, healthcare, and other basic necessities in the two locations you select. Total monthly expenditure you can expect to incur depends on the cost of housing, food, utilities, transportation, healthcare, other miscellaneous goods and services. Note that your household composition (single or married, number of kids) and home ownership status (renting vs. owning) might affect your monthly expenses.

Housing Cost

It costs about 2 percent less than the national average to live in Charlotte, according to the most recent C2ER Cost of Living Index. Inside, you’ll find the details behind that quarterly report, including detailed prices for a variety of goods and services as well as comparisons to other large metro areas throughout the country. For a 915-square-foot apartment, you can expect to pay around $144 a month for your basic utility costs, which would include your electric bill, plus costs for your apartment’s heating, cooling, water, and garbage.

What categories are included in the cost of living calculator?

Current cityIf you can't find a city, you can type the state name to see all cities available in that state. Watch the short video below to learn about HomeLight’s Buy Before You Sell program that lets you move into your new Charlotte home now and sell your current house with peace of mind and on your timeline. According to Insurance.com, as of Jan. 2024, the average cost of homeowner’s insurance in North Carolina is $2,727 a year, or $227 a month.

Property insurance

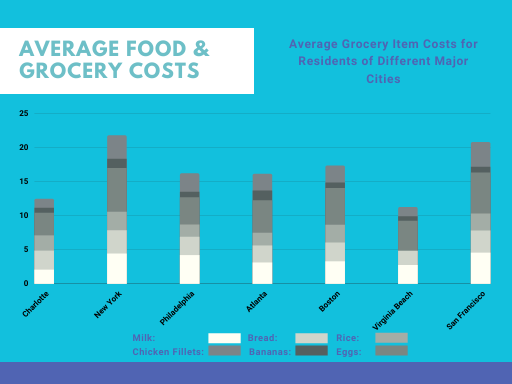

Grocery costs in Charlotte are six percent lower than the national average. Publix is one of the most popular grocery chains in the area (and one of the highest-rated in the country). Charlotte is also home to Food Lion, Sprouts, Harris Teeter, and Bargain Max. Residents can also find national chains like Trader Joe’s and Walmart throughout the city. While Spectrum is the dominant internet provider, there are other niche options to choose from.

Q: What are the pros and cons of living in Charlotte, NC?

With 14 parks in total (and counting), Charlotte has nearly 11,000 square feet of green space per resident. Census data from March 2024, Charlotte experienced the nation’s sixth-largest population increase in the past year. PODS can corroborate that trend with their own data — Charlotte ranked as the 16th city with the most move-ins, according to 2023 moving trends.

Economy

Your income will also become stretched with childcare costs if you plan on starting or expanding your family, so factor that into your decision-making when investigating where you can afford to live comfortably. A local index is typically standardized, with a base city assigned a baseline index value (usually set at 100). For example, a North Carolina community with a CLI of 125 would signify that living there is 25% more expensive than the base location, while an index of 75 indicates it’s 25% less expensive. If you aren’t sure about living in downtown Charlotte, you can look to buy or rent property outside of the city.

How does it compare?

These taxes can increase the overall cost of living as residents save money on groceries and other costs, but then pay sales tax. However, the national average for sales tax is 7.05 percent, which means the North Carolina rates aren’t much higher than the rest of the country. Get an estimate of income required to live comfortably in Charlotte. Our cost of living calculator will give you an estimate of your expected expenditures on food, utilities, transportation, housing, healthcare, and more.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Housing is considered a necessity, an essential cost of living that cannot be avoided.

Viasat, HughesNet, and Open Broadband are all expanding their services to the area. If you want to live somewhere only an hour from stunning mountain getaways, while enjoying all the benefits of city life, then consider Charlotte. Located in the center of the state, Charlotte is close to the South Carolina border and two hours east of Asheville. Charlotte is the meeting point of several interstates, including I-85 and I-77.

Moving to Charlotte: Pros and Cons - Baltimore Post-Examiner

Moving to Charlotte: Pros and Cons.

Posted: Wed, 04 Oct 2023 07:00:00 GMT [source]

Whether you use a cost of living index or a cost of living calculator, each will help you feel more confident in deciding where to live. If you want more information about one of the cities you’ve compared, you can use NerdWallet’s City Life tool for data on local schools and businesses, walkability and demographics — more than basic cost comparisons. Input the city name and state abbreviation for other locations to see their information.

We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs. On the other hand, if you need to be location-flexible or don’t have enough funds built up yet for a down payment, renting is probably the better option. However, if buying a home is in your plan, use this time to save by taking on a roommate, renting a cheaper apartment or moving in with family. Also, open a dedicated savings account to earmark money for your down payment. So when deciding where to live, determine whether your income level will be able to keep pace with cost of living increases.

This means your commute might be shorter if you move to Charlotte from another state. All information is provided exclusively for consumers' personal non-commercial use, and may not be used for any purpose other than to identify prospective properties for purchase. Use of this data provided by MLS GRID may be subject to an end user license agreement prescribed by CANOPY MLS if any and as amended from time to time. Listing provided courtesy of Triangle MLS, Inc. of NC, Internet Data Exchange Database.

Total annual household expenditures averaged $66,928 in 2021, according to the Bureau of Labor Statistics (BLS). Here are some common categories and general estimated costs to factor in when figuring out where you can afford to live. The data for this calculator is derived from the C2ER Cost of Living Index. This index is designed to measure the cost of living for a mid-management four person family.

According to the 2019 U.S. census, the median household income in Charlotte was $62,817 per year. The job market in Mecklenburg County is seeing an improvement since July 2020 when unemployment was over 10%. You can expect to pay anywhere from $700 to $900 for a cheaper one-bedroom apartment in Charlotte and the surrounding area. Two-bedroom apartments fall closer to $900-$1,100 for cheap options, while three-bedrooms are around $1,200 per month. It sets the amount you need to cover your basic expenses and have money left over for savings, entertainment, and other non-essential costs.